If health insurance doesnt cover a test – If health insurance doesn’t cover a test, navigating the process can be frustrating. This guide explores the complexities of uncovered medical tests, from understanding coverage gaps to exploring financial alternatives and patient rights. We’ll cover everything from deciphering insurance policies to appealing denied claims, providing a comprehensive resource for patients facing this challenging situation.

This article will delve into the specific situations where insurance might not cover a test, analyzing the various factors at play, and exploring different insurance plans and their policies. We’ll also detail the claims process, highlighting the steps to take when a claim is denied, and the role of healthcare providers in this process. Understanding your rights and responsibilities as a patient is crucial, and we’ll Artikel those aspects as well.

Understanding Coverage Gaps

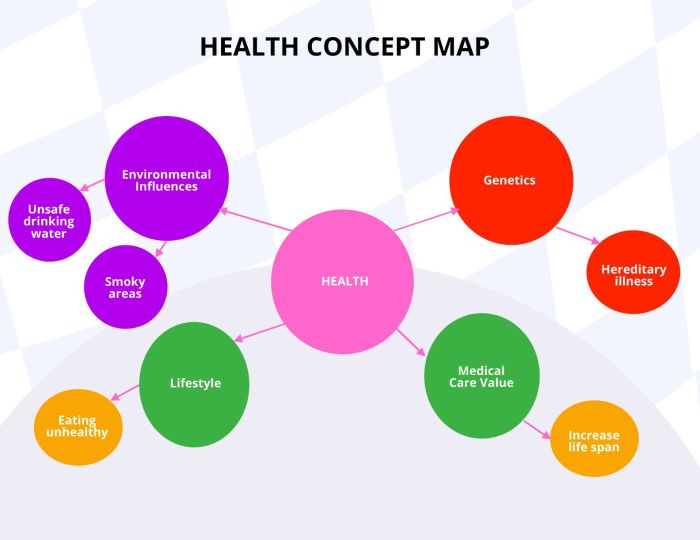

Navigating the complexities of health insurance can be daunting, especially when it comes to specific medical tests. Understanding what your policy covers and doesn’t cover is crucial for making informed healthcare decisions. This section delves into the specifics of coverage gaps related to medical testing, highlighting common exclusions and the factors influencing coverage decisions.Health insurance policies often have limitations or exclusions regarding medical tests.

This isn’t necessarily a sign of poor coverage; rather, it reflects the need to balance affordability and accessibility of healthcare services. The specifics of what’s covered vary significantly depending on the type of plan and the provider.

Types of Health Insurance Plans and Coverage Policies

Different health insurance plans offer varying degrees of coverage. These plans, including HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), EPOs (Exclusive Provider Organizations), and POS (Point of Service) plans, have distinct structures that impact coverage for medical tests. HMOs typically have more limited networks and require referrals for specialists, which might influence the coverage of certain tests.

PPOs offer broader networks and generally allow more flexibility in choosing providers, which may lead to better test coverage. EPOs and POS plans fall somewhere in between these extremes. Understanding the nuances of each plan is essential for accurately predicting coverage.

Common Exclusions and Limitations

Insurance policies frequently exclude or limit coverage for certain medical tests, particularly those deemed preventative, investigational, or deemed medically unnecessary. These limitations are often based on factors like the test’s cost, frequency, and perceived necessity. For instance, some policies might not cover routine blood tests unless they are ordered in conjunction with a specific diagnosis. Similarly, the coverage for genetic testing may be limited or excluded entirely depending on the plan.

Factors Determining Test Coverage

Several factors influence whether a particular medical test is covered by an insurance plan. These factors include the plan’s specific policy, the test’s medical necessity, and the provider’s qualifications. For example, a test deemed medically necessary by a board-certified specialist might be covered, whereas a less essential test may be excluded. Moreover, the provider performing the test might influence coverage; in-network providers are usually preferred and may result in greater coverage.

A test ordered by an out-of-network provider may have reduced or no coverage.

Ugh, health insurance not covering a specific test can be a real bummer, especially when you’re trying to figure out your next steps. For example, if you have HER2-negative breast cancer, a tailored diet can significantly impact your well-being. Discovering a plan like the her2 negative breast cancer diet could be crucial for managing symptoms and improving quality of life.

Still, navigating those out-of-pocket costs for tests can be tricky, so it’s important to explore all your options.

Comparison of Coverage Policies Between Different Insurance Providers

Insurance providers differ significantly in their coverage policies for medical tests. One provider might cover a specific test fully, while another may only cover a portion of the cost. These differences can be attributed to the provider’s specific guidelines and the overall cost of healthcare. Comparing policies across different providers is essential for selecting the best coverage.

Typical Coverage Patterns of Medical Tests

| Category of Medical Test | Typical Coverage Pattern |

|---|---|

| Routine Blood Tests | Often covered, but may have limitations depending on the plan and medical necessity. |

| Imaging Tests (X-rays, CT scans, MRIs) | Generally covered for medically necessary reasons, but may have co-pays, deductibles, or limitations on frequency. |

| Genetic Testing | Coverage varies significantly, with some plans covering specific types of genetic tests while excluding others. |

| Specialized Diagnostic Tests | Coverage depends on the test’s medical necessity and the provider’s approval. |

| Preventative Screening Tests | May or may not be covered depending on the plan’s specific preventative care policy. |

This table provides a general overview; specific coverage details should be verified with the insurance provider.

Navigating the Claims Process

Understanding that your health insurance doesn’t always cover every medical test can be frustrating. This section delves into the practical steps you can take when a test isn’t covered, from reviewing your policy to appealing a denial. Knowing your rights and procedures can empower you to effectively manage these situations.

Reviewing Insurance Policy Details

A crucial first step is thoroughly reviewing your insurance policy. Policy documents Artikel specific coverage details, including exclusions, limitations, and the pre-authorization requirements for various medical procedures. Understanding these details beforehand can prevent unnecessary costs and potential misunderstandings. Familiarize yourself with the terms and conditions, especially those related to diagnostic tests. This proactive approach can help you avoid costly surprises.

Steps for Appealing a Denied Claim

When a claim is denied, don’t despair. A systematic approach can significantly improve your chances of a favorable outcome. Start by carefully reviewing the denial letter, which often provides specific reasons for the rejection. This initial review is vital for understanding the basis for the denial. Then, gather all supporting documentation, such as pre-authorization requests, medical records, and physician letters justifying the necessity of the test.

Contact your insurance provider to inquire about their appeals process. This process often involves a specific form or procedure Artikeld in your policy.

Communication Strategies with Insurance Providers

Effective communication is key when dealing with insurance providers regarding a denied claim. Maintain a professional and polite tone in all correspondence. Clearly articulate the reasons why you believe the test should be covered. Provide supporting documentation and relevant information concisely and methodically. Keep detailed records of all communications, including dates, times, and the names of the individuals you spoke with.

This documentation will be valuable if you need to escalate the matter.

Role of a Healthcare Provider

Your healthcare provider plays a significant role in assisting you through this process. They can provide essential medical information to support your claim and help you understand the necessity of the test. They can also help navigate the pre-authorization process and gather the necessary supporting documentation. Be proactive in communicating with your doctor about your insurance coverage concerns.

They are often well-versed in the complexities of insurance claims and can offer valuable insight.

Table: Navigating a Denied Claim

| Steps | Actions | Potential Outcomes |

|---|---|---|

| Review Denial Letter | Carefully examine the reasons for denial. | Clarifies the basis for the rejection. |

| Gather Supporting Documentation | Compile medical records, pre-authorization requests, and physician letters. | Provides evidence to support your claim. |

| Contact Insurance Provider | Inquire about their appeals process and provide supporting documentation. | Clarifies procedures and potentially initiates the appeal process. |

| Appeal the Decision | Follow the specific steps Artikeld in the insurance policy and appeal form. | Potentially successful appeal or a further explanation of the denial. |

| Follow Up | Regularly check on the status of your appeal. | Keeps you informed about the progress and allows for further action if needed. |

Financial Implications and Alternatives

Facing an uncovered medical test can be a significant financial burden. The cost of these procedures can range from hundreds to thousands of dollars, potentially impacting a patient’s financial stability. Understanding the potential financial implications and available alternatives is crucial for navigating this challenging situation.The cost of an uncovered medical test can create a substantial financial strain, especially for those with limited resources.

Unexpected expenses like this can lead to difficulties in meeting other essential needs. Knowing your options and exploring financial assistance programs can help mitigate this impact.

Financial Assistance Programs

Numerous financial assistance programs are available to help patients manage the costs of medical expenses, including uncovered medical tests. These programs provide various levels of support, depending on individual circumstances and program eligibility criteria. Understanding the types of assistance available can ease the financial burden.

- Patient Financial Assistance Programs: Many healthcare providers and hospitals offer their own financial assistance programs to help patients with high medical bills. These programs often consider factors such as income, family size, and other financial obligations when determining eligibility and the amount of assistance.

- Governmental Assistance Programs: Several government programs provide financial assistance for medical expenses. Medicaid, for example, offers coverage for qualifying individuals and families, often including necessary medical tests. Eligibility requirements vary by location and program, so it’s essential to research specific programs and their requirements.

- Non-profit Organizations: Numerous non-profit organizations offer financial aid to patients facing medical expenses. These organizations often focus on specific medical conditions or demographics, providing resources and support to those in need.

Options for Managing Uncovered Costs

When the cost of an uncovered medical test is prohibitive, patients have several options to explore. Exploring these options proactively can help alleviate the financial stress.

- Negotiating with Healthcare Providers: Many healthcare providers are willing to negotiate the cost of an uncovered test. Explaining your financial situation and exploring payment options can sometimes lead to a more manageable price.

- Seeking Second Opinions: Obtaining a second opinion from another healthcare provider can potentially identify more affordable options for the same medical test. This approach can ensure the test is necessary and explore alternative diagnostic methods that may be less costly.

- Exploring Payment Plans: Some healthcare providers or medical facilities offer payment plans that allow patients to spread the cost of an uncovered medical test over several months. These plans can help manage the financial burden by making payments more manageable.

- Utilizing Credit Cards or Loans: Using credit cards or loans can be a temporary solution for covering the cost of an uncovered medical test. However, it’s essential to carefully consider the interest rates and repayment terms before making this choice.

Comparison of Payment Options

Different payment options offer varying degrees of financial relief and potential risks. Understanding the pros and cons of each method is vital for informed decision-making.

Ugh, health insurance didn’t cover that crucial test? Don’t despair! Sometimes, a simple warm compress can offer soothing relief while you wait for alternative solutions. Learning how to make a warm compress at home can be surprisingly helpful how to make a warm compress. Just remember, though, that this is a temporary solution, and you should still explore other options to get the test covered if possible.

- Payment Plans: These plans typically involve fixed monthly payments and can be helpful for spreading out the cost, but interest rates might apply. This option provides a structured approach to managing the financial burden.

- Credit Cards: Credit cards can offer flexibility in covering immediate costs, but the high-interest rates can quickly accumulate substantial debt if not managed carefully. This option might offer convenience but requires careful budgeting.

- Loans: Loans can offer lower interest rates than credit cards, but the application process can be more complex and involve stricter requirements. This option could be beneficial for patients with a clear understanding of the repayment schedule.

Negotiating Test Costs

Negotiating the cost of an uncovered medical test requires a clear understanding of your financial situation and the provider’s policies. Being prepared and assertive, without being aggressive, can improve the chances of a favorable outcome.

- Gathering Information: Gather information about the cost of the test and the provider’s payment policies. Understand the potential for negotiation and the provider’s willingness to work with patients.

- Communicating Your Situation: Clearly and respectfully explain your financial constraints to the provider or billing office. Be prepared to discuss your income, expenses, and any other relevant financial information.

- Exploring Payment Options: Discuss potential payment plans, reduced payment amounts, or alternative payment arrangements to find a solution that works for both parties.

Financial Assistance Program Overview

The following table provides a general overview of financial assistance programs for medical expenses. Specific eligibility requirements and benefits vary, so it’s crucial to research and contact the relevant program for details.

So, your health insurance doesn’t cover that crucial test? Ugh, frustrating, right? Luckily, there are often ways to offset the cost. Exploring alternative methods like finding a more affordable clinic or even considering if lifestyle changes like, say, does walking help lose weight , could be contributing factors, might help alleviate some of the financial burden.

Ultimately, you’ll need to figure out what’s best for your specific situation, but don’t despair! There are resources and options available.

| Program | Description | Eligibility Criteria |

|---|---|---|

| Medicaid | Government-funded healthcare program for low-income individuals and families | Income-based criteria, residency requirements |

| Medicare | Government-funded healthcare program for seniors and people with disabilities | Age, disability, or end-stage renal disease |

| Patient Assistance Programs | Offered by pharmaceutical companies, healthcare providers, and hospitals | Income-based criteria, medication or procedure-specific |

Patient Rights and Responsibilities

Understanding your rights and responsibilities as a patient regarding medical test coverage is crucial for navigating the insurance claim process effectively. Knowing what you’re entitled to and what’s expected of you can help prevent misunderstandings and ensure you receive the necessary care. This section will Artikel your rights and responsibilities, emphasizing the importance of thorough policy understanding and what to do if you feel your claim is being handled unfairly.

Patient Rights Regarding Medical Test Coverage

Insurance policies often Artikel specific rights for patients regarding medical test coverage. These rights typically center around transparency, access to information, and fair treatment during the claim process. A patient’s rights are designed to ensure they are not unfairly denied necessary medical care.

- Right to Information: Patients have the right to understand the terms of their insurance policy, including what tests are covered and under what conditions. This includes the specific coverage limits, deductibles, and co-pays associated with the tests. Policies should clearly state the criteria for pre-authorization, if required. This empowers patients to make informed decisions about their health and care.

- Right to Appeal Decisions: Insurance companies typically have a process for appealing denials of claims. Patients should understand the steps involved in appealing a denial of a covered medical test. The appeal process often includes providing additional information and documentation to support the necessity of the test.

- Right to Fair Treatment: Insurance companies must treat patients fairly and consistently throughout the claim process. This includes handling appeals and disputes promptly and thoroughly. This ensures that all parties are treated equitably and that the claim process is conducted professionally and efficiently.

- Right to Access Necessary Care: Patients have a right to access necessary medical tests that are deemed medically necessary by their healthcare provider. A physician’s recommendation should not be arbitrarily rejected. If a test is necessary for proper diagnosis and treatment, it should be covered, provided it adheres to the insurance policy.

Patient Responsibilities When Dealing with Insurance Claims

Understanding your responsibilities is equally vital for a smooth claim process. These responsibilities focus on providing accurate information, adhering to policy guidelines, and actively participating in the process.

- Accurate and Timely Information: Patients are responsible for providing accurate information to the insurance company regarding the medical test, including the reason for the test, the provider, and the date of the test. Timely submission of required paperwork is crucial.

- Adhering to Policy Guidelines: Understanding and adhering to the terms and conditions of your insurance policy is a key responsibility. This includes understanding pre-authorization requirements, if applicable. Carefully review the policy for specifics on coverage limits, and what constitutes a pre-authorized procedure.

- Proper Documentation: Patients should maintain proper documentation of the medical test, including receipts, bills, and any supporting information provided by the healthcare provider. Thorough record-keeping is vital for both the patient and the insurance company.

- Promptly Responding to Requests: Patients should promptly respond to any requests from the insurance company for additional information or documentation. This helps expedite the claims process.

Understanding Your Insurance Policy

Thoroughly understanding your insurance policy is paramount to successful claims. Insurance policies are complex documents, and careful review is necessary to comprehend coverage specifics. Insurance policies are contracts and should be treated as such.

- Review Policy Thoroughly: Take the time to review your insurance policy carefully, paying close attention to the specifics of medical test coverage. Review all details regarding deductibles, co-pays, and pre-authorization requirements. Carefully understand any exclusions.

- Consult with a Professional: If you have any questions or concerns about your policy, consulting with a qualified insurance professional can provide clarity and guidance.

What to Do If You Suspect Unfair Claim Handling

If you suspect your insurance company is not handling your claim fairly, it’s essential to know your recourse. This might involve filing an appeal or contacting a consumer protection agency.

- Contact the Insurance Company: Begin by contacting the insurance company directly to express your concerns and request a review of the claim denial. Documentation is crucial in this step.

- File an Appeal: If initial contact does not resolve the issue, file an appeal as Artikeld in your insurance policy.

- Seek Professional Assistance: Consulting with a consumer protection agency or an attorney specializing in insurance claims may be beneficial in more complex cases.

Summary Table of Patient Rights and Responsibilities

| Patient Rights | Patient Responsibilities |

|---|---|

| Right to information about coverage | Accurate and timely provision of information |

| Right to appeal decisions | Adhering to policy guidelines |

| Right to fair treatment | Proper documentation |

| Right to access necessary care | Prompt response to requests |

Alternatives and Considerations: If Health Insurance Doesnt Cover A Test

When your health insurance doesn’t cover a necessary medical test, it can feel frustrating and uncertain. This section explores various alternative diagnostic options, outlining factors to consider and providing a comparison of their accuracy and cost-effectiveness. Knowing these alternatives can empower you to make informed decisions about your health.

Alternative Diagnostic Options

Insurance coverage gaps for specific medical tests often necessitate exploring alternative diagnostic approaches. These options can vary widely in their cost, complexity, and accuracy. Choosing the right alternative depends on several key factors, including the nature of the condition being investigated, the availability of alternative tests, and the patient’s individual circumstances.

Different Diagnostic Methods

A range of diagnostic methods may be available when a preferred test isn’t covered. These alternatives can provide valuable insights, although they may not be identical to the original test. Consider these factors when evaluating different diagnostic methods:

- Imaging Techniques: Alternatives to expensive MRI or CT scans might include ultrasound or X-rays. Ultrasound uses sound waves to create images, offering a relatively inexpensive and readily available method. X-rays, while less detailed than other imaging techniques, can still detect certain conditions. Ultrasound is particularly helpful for soft tissue imaging, whereas X-rays excel at visualizing bones and dense structures.

- Blood Tests: While not a replacement for imaging, blood tests can offer crucial insights into various conditions. These tests are often more affordable than imaging scans, providing information about organ function, inflammation, and the presence of specific markers. For instance, a complete blood count (CBC) can detect anemia or infection, and specific biomarkers can point to certain diseases.

- Non-invasive procedures: In some cases, non-invasive procedures, such as endoscopies or colonoscopies, can replace or complement more expensive tests. For example, a colonoscopy can detect colorectal polyps and cancers, providing a visual examination of the colon. These procedures are less invasive than surgery, often requiring sedation but not general anesthesia.

Factors to Consider When Choosing an Alternative, If health insurance doesnt cover a test

Several crucial factors influence the selection of an alternative diagnostic method. These include the accuracy and reliability of the alternative test, its cost, the patient’s specific health needs, and the availability of the test. Consider these factors when deciding which test is most appropriate for you.

- Accuracy: The alternative test’s ability to correctly identify or rule out a condition is paramount. A less accurate test might require further investigation or lead to delayed diagnosis.

- Cost-effectiveness: Evaluate the cost of the alternative test against its potential benefit. A more expensive alternative might be justifiable if it significantly improves diagnostic accuracy or avoids more invasive procedures.

- Accessibility: The availability and location of the alternative test provider should be considered. Consider the proximity of clinics or hospitals offering the test.

Pros and Cons of Different Diagnostic Options

Each diagnostic option possesses its own advantages and disadvantages. Weighing these factors carefully can aid in selecting the most suitable approach for a given situation.

- Ultrasound: Pros include non-invasive nature, real-time imaging, and relatively low cost. Cons include potential limitations in visualizing certain structures compared to other imaging methods.

- Blood Tests: Pros include ease of performance, relatively low cost, and ability to assess various bodily functions. Cons include potential for false positives or negatives, and may not provide a direct visual assessment of the condition.

- Endoscopies: Pros include visualization of the internal organs, early detection of potential issues, and potential for treatment during the procedure. Cons include potential discomfort, risk of complications, and requirement of sedation or anesthesia.

Comparing Diagnostic Methods

The table below provides a comparative overview of different diagnostic methods, their accuracy, and approximate costs. This table can help you make an informed decision.

| Diagnostic Method | Accuracy (Rating) | Approximate Cost | Pros | Cons |

|---|---|---|---|---|

| Ultrasound | Good | $100-$500 | Non-invasive, real-time imaging | Limited visualization for some structures |

| Blood Tests | Moderate | $50-$200 | Easy to perform, assesses bodily functions | Potential for false results, lacks visual assessment |

| Endoscopy | Excellent | $500-$2000 | Visualizes internal organs, potential for treatment | Discomfort, risk of complications |

Outcome Summary

Facing a medical test not covered by insurance can be daunting, but understanding your options and rights can ease the burden. This guide has provided a roadmap to navigate this complex process, from reviewing your policy and appealing denials to exploring financial assistance and alternative diagnostic options. Remember, you’re not alone in this; resources and support are available to help you through this.

By arming yourself with knowledge, you can confidently address this challenge and focus on your health.