Health insurance options if you retire before age 65 can feel overwhelming. Navigating employer plans, individual markets, and Medicare eligibility while weighing costs and coverage is crucial. This guide breaks down the available choices, explaining the nuances of each option and helping you find the best fit for your specific circumstances.

From understanding your employer’s continuation benefits to exploring individual market plans and Medicare’s early retirement options, this article provides a comprehensive overview. We’ll delve into the factors affecting costs, eligibility, and coverage, offering practical advice and tools to make informed decisions.

Understanding Retirement Health Insurance Before 65

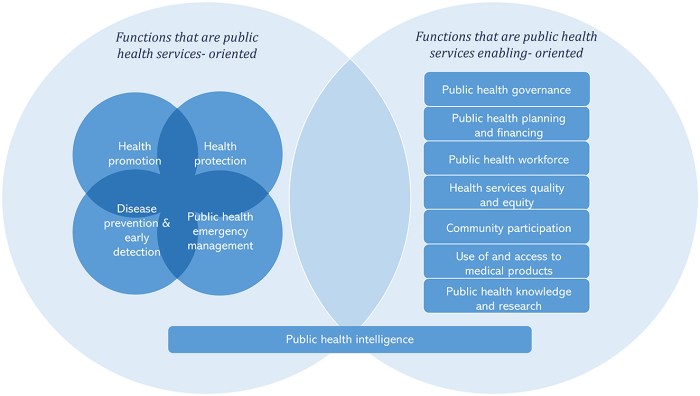

Navigating the world of health insurance can be daunting, especially when retirement looms before the typical Medicare eligibility age. Choosing the right plan is crucial for maintaining your well-being and financial security. This guide provides a comprehensive overview of the options available to those retiring before 65, outlining the key differences and factors to consider.Understanding the various health insurance options available during pre-65 retirement is essential for a smooth transition.

This involves exploring employer-sponsored plans, individual market plans, and potential Medicare options. Knowing the intricacies of these plans will help you make informed decisions to ensure you have appropriate and affordable coverage.

Common Health Insurance Options

A variety of health insurance options exist for pre-65 retirees. These options often depend on individual circumstances, such as employment status and income. The most common are employer-sponsored plans, individual market plans, and the potential for Medicare if you meet specific criteria.

Employer-Sponsored Plans

If you have an employer that offers health insurance, it’s often one of the most cost-effective and comprehensive options. Coverage is frequently substantial, and the premiums are often lower than individual plans. This option usually disappears once you retire.

Individual Market Plans

For retirees who are no longer employed or whose employer does not offer a plan, the individual market provides options. However, costs can vary widely depending on your health and location. It’s important to compare different plans and consider the level of coverage provided.

Medicare Options

In some cases, retirees may be eligible for Medicare if they meet specific conditions. For instance, if you have a qualifying disability, or are eligible for Social Security disability insurance, you might have options available earlier than 65. The eligibility criteria and coverage vary depending on the specific circumstances.

Factors Affecting Cost and Availability

Several factors influence the cost and availability of health insurance for pre-65 retirees. These include income, employment status, health conditions, and location. Each of these factors can impact the type and cost of coverage.

Impact of Income, Employment, and Health

Your income level plays a significant role in the cost of individual market plans. A higher income usually translates to higher premiums, while a lower income might qualify you for subsidies. Employment status directly affects the availability of employer-sponsored plans. A sudden loss of employment can necessitate finding an individual market plan, potentially impacting cost. Pre-existing health conditions can also impact premium costs.

Individuals with chronic conditions may find that their premiums are higher than those with good health.

Figuring out health insurance when you retire early can be tricky. Many employers offer coverage, but what if you’re one of those people who decide to retire before 65? Understanding your options is key, and that often involves looking into your potential coverage gaps. For example, if you’re diagnosed with a condition like insulinoma, learning more about its impact on your health insurance options is important.

For a comprehensive overview of insulinoma, including its potential effects on your overall well-being and how it might affect insurance, check out this resource: insulinoma overview and more. Ultimately, planning ahead and understanding your specific situation is crucial for navigating health insurance in retirement, no matter your age.

Summary of Health Insurance Plans

| Plan Type | Coverage Details | Cost Considerations |

|---|---|---|

| Employer-Sponsored | Often comprehensive, lower premiums. | Availability tied to employment, may end upon retirement. |

| Individual Market | Wide range of options, potentially higher premiums. | Premiums depend on health, location, and income. |

| Medicare (pre-65 eligibility) | Medicare Advantage or Part D plans. | Eligibility criteria depend on specific conditions, like disability. |

Employer-Sponsored Plans and Retirement

Retiring before 65 can present unique challenges when it comes to health insurance. Your employer’s plan often provides crucial coverage, but leaving employment changes the picture. Understanding how this transition works is vital for maintaining health security.Employer-sponsored health insurance plans are a significant benefit for many employees. Often, these plans offer coverage at a lower cost compared to individual plans on the market.

Figuring out health insurance when you retire before 65 can be tricky. You might need to explore COBRA or consider individual plans, but understanding your options is key. Knowing the early signs of potential health issues, like mouth cancer, is equally important. For example, if you notice unusual sores or patches in your mouth, it’s crucial to see a doctor right away to get checked out; what does mouth cancer look like can vary, and early detection is vital.

Ultimately, having a solid plan in place for health insurance when you retire early is essential for peace of mind.

However, employment cessation necessitates a careful examination of continuation options. The transition can be complicated, but understanding the options available can alleviate concerns and promote peace of mind.

COBRA Options and Costs

COBRA, or Consolidated Omnibus Budget Reconciliation Act, provides a temporary continuation of health insurance coverage after an employee leaves their job. This allows employees to maintain their current coverage but at their expense. It’s a lifeline, but crucial to understand its limitations. COBRA typically allows former employees to maintain their health insurance for up to 18 months.

COBRA Costs and Timelines

The costs associated with COBRA can vary significantly depending on the specifics of the employer’s plan. Premiums are usually substantially higher than when employed. Former employees are responsible for the entire premium, including the portion the employer previously paid. There’s a 60-day enrollment window following the employment termination date. Failure to enroll within this timeframe often results in loss of coverage.

Comparison of COBRA and Alternatives

Several alternatives to COBRA exist, each with distinct advantages and disadvantages. One alternative is to purchase a health insurance plan on the individual market. These plans can be tailored to individual needs and budgets, but may come with higher premiums. Another alternative involves enrolling in a state-sponsored health insurance exchange, which often provides affordable options for those who qualify.

These plans can be more comprehensive, with a wider range of benefits and options, but still have premiums that can be significant.

Employer Assistance with Pre-65 Retirement Plans

Some employers may offer assistance or alternative health insurance options for employees retiring early. This assistance can take various forms, such as offering subsidized plans or providing resources to help employees navigate the complexities of the insurance market. Employers may also offer short-term options that bridge the gap until the individual can secure other coverage. Some employers might even offer coverage continuation for a limited time, often for one or two years, at a cost that is more affordable than COBRA.

Table: COBRA vs. Alternatives

| Feature | COBRA | Individual Market Plan | State Exchange Plan |

|---|---|---|---|

| Cost | High, entirely employee-paid premiums | Variable, potentially higher than group plans | Variable, often more affordable than individual market |

| Coverage Duration | Up to 18 months | Ongoing, as long as the plan is maintained | Ongoing, as long as the plan is maintained |

| Eligibility | Generally applicable to former employees | Open to anyone, regardless of prior employment | Open to residents who meet eligibility criteria |

| Employer Support | Rarely employer-subsidized | No employer support | Potential for state subsidies |

Individual Health Insurance Market for Pre-65 Retirees

Retiring before the age of 65 often necessitates finding new health insurance options. The individual health insurance market presents various choices, but navigating it can be complex, especially for those accustomed to employer-sponsored plans. Understanding the factors influencing premiums, coverage, and eligibility is crucial for making informed decisions.

Options Available in the Individual Market

The individual market offers a range of health insurance plans, from basic to comprehensive coverage. These options include preferred provider organizations (PPOs), health maintenance organizations (HMOs), and point-of-service (POS) plans. Each plan structure offers different levels of flexibility and control over healthcare providers.

Factors Influencing Premiums and Coverage

Several factors play a role in determining premiums and coverage in the individual market for pre-65 retirees. These include age, health status, location, and the type of plan chosen. Generally, younger and healthier individuals tend to pay lower premiums, while those with pre-existing conditions or higher medical needs might face higher premiums. Geographical location also impacts premiums due to variations in healthcare costs across regions.

Factors Affecting Eligibility and Coverage

Eligibility criteria and coverage options within individual health insurance plans are diverse and vary based on factors like the specific plan, state regulations, and the insurer’s underwriting standards. Pre-existing conditions, for example, may affect coverage, with some plans requiring waiting periods or potentially excluding coverage entirely. Additionally, the level of coverage for specific medical procedures and treatments varies widely between plans.

Comparing Benefits and Drawbacks of Various Plans

PPO plans, often considered more flexible, allow patients to visit any doctor in their network or out-of-network, but with higher out-of-pocket costs. HMO plans typically restrict patients to in-network providers, often leading to lower premiums, but less flexibility in choosing doctors. POS plans offer a balance between these two models, giving some flexibility but still primarily focusing on in-network providers.

Each plan’s specific benefits and drawbacks should be carefully weighed, considering individual needs and preferences.

Comparison of Individual and Employer-Sponsored Plans

| Feature | Individual Market Plans | Employer-Sponsored Plans |

|---|---|---|

| Premiums | Generally higher, as they are not subsidized by the employer. | Often lower, as employers may contribute to the premium cost. |

| Coverage Options | Wide range, but can vary significantly between plans. | Typically comprehensive, determined by the employer’s plan. |

| Choice of Providers | More freedom in selecting providers, but may involve higher out-of-pocket costs for out-of-network care. | Providers are often limited to a network, though the network is typically extensive. |

| Cost Sharing | Deductibles, co-pays, and co-insurance can vary widely between plans. | Cost-sharing structures are determined by the employer’s plan. |

| Administrative Complexity | Requires more individual effort to research and choose a suitable plan. | Employer handles most of the administrative burden. |

The table above provides a concise overview of the key differences between individual market plans and employer-sponsored plans. Careful consideration of each factor is essential when choosing the most appropriate health insurance option for pre-65 retirees.

Medicare and Pre-65 Retirement

Retiring before the typical age of 65 can leave you facing unique healthcare challenges. While employer-sponsored plans often end, and individual plans may prove costly, another option emerges: Medicare. Understanding Medicare’s eligibility criteria, parts, costs, and coverage for pre-65 retirees is crucial for making informed decisions.Navigating the complexities of Medicare eligibility and coverage can be daunting for those retiring early.

This section will delve into the specifics of Medicare for pre-65 retirees, helping you understand your options and associated costs.

Eligibility Requirements for Medicare Before 65

Medicare is generally for individuals aged 65 and older. However, certain conditions can make a person eligible for Medicare before 65. These include those with end-stage renal disease (ESRD) and those with certain types of amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease. The Social Security Administration (SSA) or other government agencies provide the necessary criteria and procedures for these special cases.

Medicare Parts and Their Application to Early Retirees

Medicare is structured into several parts, each covering different aspects of healthcare. Understanding how each part applies to those retiring early is critical.

- Part A (Hospital Insurance): Part A typically covers inpatient care in hospitals, skilled nursing facilities, and hospice care. For those retiring early without ESRD or ALS, Part A coverage isn’t directly applicable unless they meet specific criteria like those with ALS or ESRD. If eligible for Medicare through ESRD or ALS, Part A coverage will be similar to standard Medicare recipients.

Figuring out health insurance when you retire early can be tricky. Many plans require a certain age to qualify for coverage, so if you’re planning on retiring before 65, you’ll need to research options like COBRA or Medicare’s Part A and B. It’s also super important to advocate for yourself with your doctor, especially if you’re dealing with weight stigma.

A great guide on self-advocacy at the doctor’s office can be found here. This can help you feel empowered to get the best possible care and make sure your health needs are met during this transition. Ultimately, finding the right health insurance plan is crucial for your well-being during retirement.

In summary, eligibility and coverage under Part A depend on the reason for early Medicare eligibility.

- Part B (Medical Insurance): Part B covers many services, including doctor visits, outpatient care, and preventive services. Early retirees who qualify for Medicare will typically need to pay a monthly premium for Part B coverage, as well as potentially other associated costs.

- Part C (Medicare Advantage): Part C plans are offered by private insurance companies and are an alternative way to get your Medicare benefits. They may include extra benefits beyond the standard Medicare coverage but come with their own premiums and costs. Early retirees who qualify for Medicare through ESRD or ALS will be able to consider Part C.

- Part D (Prescription Drug Insurance): Part D helps cover prescription drug costs. For early retirees, Part D is typically an optional addition to their Medicare coverage, and a monthly premium will be required. Those eligible for Medicare through ESRD or ALS may also need to enroll in Part D to cover their prescription medications.

Costs and Coverage Limitations

Medicare, even for those eligible before 65, has associated costs. Premiums for Part B, Part C, and Part D will need to be considered. Coverage limitations exist across all parts of Medicare, and early retirees should be aware of any potential gaps in coverage for certain procedures or services. Costs and coverage limitations vary based on the individual’s specific circumstances and the chosen Medicare plan.

Comparison of Medicare Options for Early Retirees

Early retirees have choices in how they receive Medicare coverage. Choosing the best option requires weighing the benefits and drawbacks of each.

- Original Medicare (Parts A and B): This is the traditional Medicare program. While often having a lower monthly premium than Medicare Advantage, it may not include additional benefits found in private Medicare Advantage plans.

- Medicare Advantage (Part C): These plans offered by private companies often include extra benefits beyond basic Medicare, but come with premiums and may have specific coverage limitations. This may be a preferable option for some pre-65 retirees.

Medicare Parts Implications for Early Retirees

| Medicare Part | Description | Implications for Early Retirees |

|---|---|---|

| Part A | Hospital insurance | Coverage varies based on eligibility criteria. |

| Part B | Medical insurance | Monthly premiums are typically required. |

| Part C | Medicare Advantage | Potential for additional benefits but also premiums. |

| Part D | Prescription drug insurance | Optional but often necessary for prescription drug coverage. |

Navigating the Application Process

Applying for health insurance, especially when retiring early, can feel daunting. The process can be complex, involving various options and requirements. This section provides a comprehensive guide to navigating the application process for different health insurance types. Understanding the steps and necessary documentation is crucial for a smooth transition to your new coverage.

Individual Market Plan Application

The individual health insurance market offers a variety of plans, each with varying premiums and benefits. Applying for an individual plan typically involves several steps. Gathering the required information and documents upfront significantly streamlines the process.

- Gather personal information: This includes your name, date of birth, contact information, and current health status, including any pre-existing conditions. It’s vital to be completely honest about your health history when completing applications.

- Identify your coverage needs: Consider your medical history, anticipated healthcare needs, and budget. Review different plans’ benefits, coverage, and costs.

- Select a plan: Compare plans based on factors like premiums, deductibles, co-pays, and coverage. Use online comparison tools to narrow down options.

- Complete the application form: Carefully fill out the application form, providing accurate and complete information. Any discrepancies could affect your approval.

- Provide necessary documents: This may include proof of income, identification, and any required medical records. Specific documents will vary by insurer and plan.

- Review the policy terms and conditions: Thoroughly review the policy document before signing the application. Understand the coverage limits, exclusions, and any other important stipulations.

- Submit the application: Submit your completed application, including all required documents, to the insurance company. Keep a copy for your records.

- Awaiting approval: Be prepared to wait for a response. The time it takes to receive approval can vary based on the insurer and your situation.

Employer-Sponsored Plan or COBRA Application

Switching to an employer-sponsored plan after retirement, or using COBRA to maintain coverage, often involves specific procedures. It’s important to understand these procedures and timelines.

- Check your employer’s plan details: Understand your employer’s plan eligibility requirements and deadlines for retirement plan coverage.

- Gather necessary documentation: This might include your employment history, proof of retirement, and other required documents as specified by your employer or the plan administrator.

- Complete the required forms: Your employer or plan administrator will provide the necessary forms. Carefully fill out all the information and submit the documents by the due date.

- Understand the coverage timeline: The continuation of your coverage, whether through your employer or COBRA, usually has a specific timeframe. Be aware of the limitations and deadlines to avoid losing coverage.

- Contact the plan administrator: If you have questions or encounter difficulties during the process, contact the plan administrator for assistance.

Importance of Understanding Policy Terms and Conditions

Understanding the nuances of your health insurance policy is vital. It protects you from unexpected costs or coverage gaps. The policy details contain crucial information, including coverage limits, exclusions, and claim procedures.

Review the terms and conditions carefully before signing any application or accepting a policy. Understand the language and definitions used in the policy. Ask questions if you don’t understand something.

Cost Considerations for Pre-65 Retirees: Health Insurance Options If You Retire Before Age 65

Navigating the world of health insurance as a pre-65 retiree can be challenging, especially when considering the financial aspects. Understanding the factors influencing costs is crucial for making informed decisions about your coverage. This section delves into the key cost considerations, providing insights into how age, health, and location impact premiums and options for finding affordable plans.The cost of health insurance for pre-65 retirees is often higher than for those with employer-sponsored coverage.

This is primarily due to the lack of employer contributions and the fact that insurers assess individual risk profiles more closely. However, various factors can influence the specific premium amount, and a comprehensive understanding of these factors is essential.

Factors Affecting Health Insurance Premiums

Premiums for health insurance plans are influenced by a complex interplay of factors. Age is a significant determinant, with older individuals typically facing higher premiums. This is because the risk of developing health conditions increases with age, and insurers factor this into their pricing models.Health status is another crucial factor. Individuals with pre-existing conditions or a history of health issues generally face higher premiums.

Insurers assess the risk associated with insuring these individuals and adjust the premiums accordingly.Location also plays a role in the cost of health insurance. Premiums can vary significantly based on geographic location, due to differences in healthcare costs and the prevalence of certain health conditions. For example, areas with a higher concentration of specialized medical facilities might have higher premiums, reflecting the increased availability of advanced treatments.

Methods for Finding Cost-Effective Options

Finding affordable health insurance options requires a proactive approach. Comparing quotes from multiple insurers is essential, as plans and premiums can vary significantly. Utilizing online comparison tools and consulting with independent insurance agents can help in this process. Leveraging discounts, such as those offered for health-conscious individuals or those who participate in preventative care programs, can also reduce the overall cost.Another cost-effective strategy is to consider plans with higher deductibles.

While the initial out-of-pocket expense is higher, the monthly premiums are typically lower. This approach is suitable for individuals who anticipate minimal healthcare utilization. It’s important to weigh the potential savings against the potential costs if unexpected health issues arise.

Understanding Deductibles, Co-pays, and Coinsurance

Understanding the components of a health insurance plan is vital. A deductible is the amount you must pay out-of-pocket for covered services before your insurance begins to pay. Co-pays are fixed amounts you pay for specific services, such as doctor visits or prescription drugs. Coinsurance is the percentage of costs you are responsible for after meeting your deductible.

Understanding these terms is crucial to accurately assessing the total cost of care.For example, a plan with a high deductible might have lower monthly premiums, but you’ll be responsible for a larger out-of-pocket expense if you need significant medical care. Conversely, a plan with a low deductible might have higher premiums, but you’ll have lower out-of-pocket expenses in the event of a health issue.

Comparison of Health Insurance Costs

| Health Insurance Option | Typical Premium (Estimated) | Deductible (Estimated) | Copay (Estimated) | Coinsurance (Estimated) |

|---|---|---|---|---|

| High Deductible Health Plan (HDHP) | $300-$500/month | $3,000-$5,000 | $20-$50 | 20%-30% |

| Preferred Provider Organization (PPO) | $400-$700/month | $1,000-$2,000 | $20-$40 | 10%-20% |

| Health Maintenance Organization (HMO) | $200-$400/month | $500-$1,000 | $10-$30 | 0%-10% |

Note: These are estimated figures and can vary greatly depending on individual circumstances.

Health Insurance Options for Specific Situations

Retiring before 65 can present unique challenges when choosing health insurance. Navigating the complexities of pre-existing conditions, chronic illnesses, disabilities, and specific health needs requires careful consideration. Understanding the available options and the associated costs is crucial for ensuring financial security and access to quality healthcare.The health insurance landscape for pre-65 retirees is multifaceted. Different plans cater to various health situations, offering varying levels of coverage and costs.

This section delves into specific health needs, exploring the options and support available.

Health Insurance for Retirees with Pre-Existing Conditions, Health insurance options if you retire before age 65

Pre-existing conditions often affect the availability and cost of health insurance plans. Many plans, both employer-sponsored and individual, require careful evaluation to understand the coverage limitations. Premiums may be higher than for those without pre-existing conditions. Many insurance providers utilize actuarial tables to determine premiums, which incorporate the probability of claims based on the risk profile of the insured population.

This can result in higher premiums for individuals with conditions that increase the likelihood of needing healthcare services. Understanding these factors is vital in making informed choices about health insurance.

Availability and Cost Implications of Plans for Chronic Illnesses

Chronic illnesses require comprehensive and ongoing care. Individual plans, as well as those from insurers, may provide coverage for specific chronic conditions, but this varies significantly. Some plans may have restrictions or exclusions. This necessitates a careful review of the policy documents to understand the level of coverage. Costs for chronic illnesses can be substantial, and retirees with these conditions should explore various plans to find the best fit for their needs.

The costs of medications and treatments for chronic illnesses can vary significantly, and this is an important factor to consider when comparing plans.

Options for Retirees with Disabilities or Specific Health Needs

Retirees with disabilities or specific health needs often require specialized coverage. Some plans may have specific benefits for these situations, such as enhanced coverage for rehabilitation or therapies. Understanding the specific requirements and options for disability coverage is crucial for those with disabilities. Many insurance companies offer plans that accommodate particular health needs, but it’s essential to thoroughly examine the details to ensure adequate coverage for medical equipment, therapies, and other necessary services.

This necessitates a comprehensive understanding of the plan’s provisions and limitations.

Role of Subsidies and Assistance Programs

Subsidies and assistance programs can significantly reduce the cost of health insurance for pre-65 retirees. These programs are designed to help those with limited incomes. Eligibility criteria vary, and it’s important to explore options such as the Affordable Care Act (ACA) subsidies and state-based assistance programs. Many programs may offer financial aid, helping to make healthcare more accessible for those with limited financial resources.

The specific requirements for eligibility and the amount of assistance available may vary by location and individual circumstances.

Resources and Assistance Programs

The following resources and programs can provide support in managing health insurance costs for pre-65 retirees:

- The Health Insurance Marketplace: The Health Insurance Marketplace (formerly known as Healthcare.gov) offers a platform to compare and purchase health insurance plans.

- State Health Insurance Assistance Programs (SHIPs): SHIPs offer free and confidential assistance to individuals in finding and understanding health insurance options. They can provide guidance in navigating the application process and eligibility criteria.

- Consumer Protection Agencies: State and federal consumer protection agencies can help resolve issues related to insurance claims or disputes.

- Nonprofit Organizations: Numerous nonprofits offer support to individuals struggling with healthcare costs. These may include financial aid or educational resources.

Outcome Summary

Retiring before 65 presents unique health insurance challenges. Understanding the options, from employer-sponsored plans and COBRA to individual market coverage and Medicare, is key to ensuring you have the appropriate health protection. This guide has provided a thorough look at the complexities, enabling you to make well-informed decisions about your health insurance needs as a pre-65 retiree. Remember to consult with a financial advisor or healthcare professional for personalized advice.