Affordable care act what you should know – Affordable Care Act: What You Should Know provides a comprehensive overview of the Affordable Care Act (ACA), a landmark piece of legislation that significantly reshaped the US healthcare landscape. This exploration delves into the key provisions, historical context, and impact on various demographics. From access to coverage to cost considerations and individual mandates, we’ll unpack everything you need to understand this complex yet crucial topic.

This guide explores the ACA’s history, its effects on various groups, and the ongoing debates surrounding its effectiveness. Understanding the ACA is essential for anyone navigating the complexities of healthcare in the United States. The information here aims to provide a clear, accessible summary of this important policy.

Overview of the Affordable Care Act (ACA)

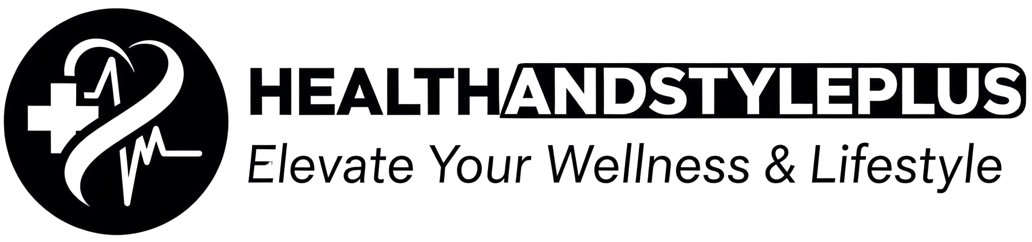

The Affordable Care Act (ACA), often called Obamacare, is a landmark piece of legislation that significantly reshaped the American healthcare landscape. It aimed to expand health insurance coverage to millions of previously uninsured Americans and improve the quality and affordability of health insurance. This comprehensive reform had a profound impact on the healthcare system and continues to be a subject of debate and discussion today.The ACA was enacted in 2010 amid a backdrop of rising healthcare costs and a significant number of uninsured Americans.

Advocates argued that the existing system, with its reliance on employer-sponsored insurance, left many vulnerable populations without adequate coverage. The legislation’s primary goals were to expand access to affordable healthcare, control costs, and improve the quality of care. These goals were pursued through a multifaceted approach, involving subsidies for individuals, mandates for insurance coverage, and regulations for insurance companies.

Key Provisions of the ACA, Affordable care act what you should know

The ACA included several key provisions designed to achieve its goals. These provisions sought to increase access to affordable healthcare by expanding the pool of insured individuals, reducing insurance costs, and creating a more competitive insurance market. The Act’s impact on the healthcare industry was substantial and complex, prompting ongoing adjustments and modifications.

- Individual Mandate: The ACA required most Americans to have health insurance or pay a penalty. This mandate aimed to increase the number of insured individuals, thereby reducing the overall cost of healthcare. The penalty amounts have changed over time. Examples of people who were typically exempt from the mandate include those with religious objections or those who faced undue hardship in obtaining coverage.

- Health Insurance Marketplaces (Exchanges): The ACA created online marketplaces where individuals and small businesses could compare and purchase health insurance plans. These marketplaces provided a centralized platform for consumers to explore various options, helping them find coverage that met their needs and budget. The exchanges also offered subsidies to help make health insurance more affordable for those with lower incomes.

- Essential Health Benefits: The ACA mandated that all health insurance plans offered through the marketplaces must cover certain essential health benefits, such as preventive services, hospitalization, and prescription drugs. This provision aimed to ensure that all Americans had access to basic medical care.

- Medicaid Expansion: The ACA offered states the option to expand their Medicaid programs to cover more low-income adults. Some states chose to expand Medicaid, while others did not. This led to varying levels of coverage expansion across the country. Medicaid expansion is a key component of the debate surrounding the ACA’s effectiveness and fairness.

Types of Health Insurance Plans under the ACA

The ACA established different types of health insurance plans to cater to various needs and budgets. These plans offer varying levels of coverage and cost structures.

- Bronze Plans: Bronze plans offer the lowest premiums but generally provide the lowest level of coverage. They require higher out-of-pocket costs for covered services.

- Silver Plans: Silver plans represent a moderate balance between premiums and coverage. They are often a popular choice for individuals seeking a reasonable balance of cost and benefits.

- Gold Plans: Gold plans offer a higher level of coverage but come with higher premiums. They are typically a good choice for individuals who anticipate needing more extensive medical care.

- Catastrophic Plans: Catastrophic plans are designed for individuals who anticipate minimal need for medical care. They have very low premiums but have high out-of-pocket costs for most services.

Comparison of Health Insurance Plans

The following table provides a comparison of the different health insurance plans available under the ACA. It details the coverage, cost, and key features.

| Plan Type | Coverage | Cost (Premiums) | Features |

|---|---|---|---|

| Bronze | Lower coverage | Lowest premiums | Higher out-of-pocket costs |

| Silver | Moderate coverage | Moderate premiums | Reasonable balance of cost and benefits |

| Gold | Higher coverage | Higher premiums | Lower out-of-pocket costs |

| Catastrophic | Very limited coverage | Lowest premiums | High out-of-pocket costs |

Access to Affordable Healthcare

The Affordable Care Act (ACA) aimed to expand access to affordable healthcare, particularly for those previously uninsured or underinsured. This effort has had a noticeable impact on various demographics, although challenges remain. The ACA’s impact is not uniform, and its effects vary significantly depending on individual circumstances and location.The ACA significantly altered the landscape of healthcare access, particularly for vulnerable populations.

It sought to address systemic inequities and improve health outcomes for those historically marginalized. The legislation introduced provisions designed to make coverage more accessible and affordable, impacting low-income individuals, minorities, and others who had struggled to obtain insurance.

Impact on Different Demographics

The ACA aimed to expand coverage to underserved populations, including low-income individuals and minorities. It introduced subsidies to help lower-income individuals afford health insurance premiums, making coverage more attainable. By expanding Medicaid eligibility, the ACA also provided access to coverage for many low-income individuals.

Examples of Expanded Coverage

The ACA expanded coverage through various avenues. One key example was the creation of health insurance exchanges, which allowed individuals to compare plans and potentially find more affordable options. Furthermore, the ACA mandated that health insurance plans cover essential health benefits, such as preventive care and hospitalization. This ensured that even individuals with limited incomes had access to necessary medical services.

Role of Health Insurance Exchanges

Health insurance exchanges, established by the ACA, played a pivotal role in making coverage more accessible. These online marketplaces provide a platform for individuals to compare different health insurance plans from various providers, including the cost of premiums and coverage details. The exchanges allowed individuals to select plans that best suited their needs and budget, leading to greater transparency and informed decision-making in the insurance selection process.

Enrollment Periods and Procedures

Understanding the enrollment periods and procedures is crucial for accessing ACA coverage. The annual open enrollment period is the most common way to sign up for or change plans, but special enrollment periods may be available under certain circumstances.

| Enrollment Period | Description |

|---|---|

| Annual Open Enrollment | A designated period each year when individuals can enroll in or change their health insurance plans. This is the most common enrollment period. |

| Special Enrollment Periods (SEPs) | These periods allow individuals to enroll or change their plans outside the annual open enrollment period. Circumstances that may trigger an SEP include getting married, having a baby, losing a job, or moving. These periods are crucial for those experiencing significant life changes that affect their insurance needs. |

The enrollment procedures typically involve completing an application online or through a designated marketplace, providing necessary personal and financial information, and choosing a plan that best fits individual needs and budget. Information on the specific steps can be obtained from the HealthCare.gov website.

Cost and Premiums

The Affordable Care Act (ACA) aimed to make healthcare more accessible and affordable. However, the impact on premiums and out-of-pocket costs has been complex and varied, influenced by factors both within and beyond the Act’s provisions. Understanding these intricacies is key to evaluating the ACA’s overall effectiveness.The ACA’s initial goal was to reduce healthcare costs and make plans more affordable.

However, the actual experience for individuals and families has been a mix of positive and negative outcomes, with some seeing lower costs and others facing increases. The impact depends on various factors, including individual health status, location, and the specific plan chosen.

Impact on Healthcare Premiums and Out-of-Pocket Costs

The ACA has had a mixed impact on healthcare premiums and out-of-pocket costs. While some individuals have experienced lower premiums, others have seen increases. The impact often depends on factors such as individual health status, location, and plan choices. In some cases, the ACA’s cost-containment measures have been effective in keeping premiums from rising as much as they might have without the law’s intervention.

Factors Influencing the Cost of Healthcare Plans

Several factors contribute to the cost of healthcare plans under the ACA. These factors include:

- Individual health status: People with pre-existing conditions or chronic illnesses typically have higher healthcare needs and thus higher premiums.

- Location: The cost of healthcare services can vary significantly by region. Areas with higher healthcare costs will typically result in higher premiums.

- Plan choices: Different plans offer varying levels of coverage, influencing the cost. A plan with comprehensive coverage will generally have a higher premium than a plan with limited coverage.

- State-level variations: The ACA allows states to design their own healthcare marketplaces and regulations, which can affect the cost and availability of plans.

Ways the ACA Attempts to Control Healthcare Costs

The ACA has implemented several strategies to control healthcare costs, including:

- Market reforms: The ACA aimed to increase competition among insurance providers and incentivize the development of more affordable plans. The goal is to promote competition, which can drive down costs.

- Preventive care: The ACA expanded access to preventive services, encouraging healthier lifestyles and reducing the need for expensive treatments later. This can ultimately lower long-term healthcare costs.

- Cost-sharing reductions (CSR): These subsidies help offset the cost of premiums for lower-income individuals and families, making healthcare more affordable.

- Negotiating drug prices: The ACA introduced mechanisms to potentially lower the costs of prescription drugs, though the extent of their impact is still being assessed.

Subsidies Available to Help Afford Healthcare

The ACA offers various subsidies to help individuals afford healthcare plans. These subsidies aim to make healthcare more accessible to those with lower incomes.

| Type of Subsidy | Description |

|---|---|

| Premium Tax Credits | Financial assistance to help pay for health insurance premiums. Eligibility is based on income and household size. The subsidy amount varies depending on the individual’s income and the cost of the plan. |

| Cost-Sharing Reductions (CSR) | These subsidies help lower out-of-pocket costs, such as deductibles and co-pays. They are generally tied to premium tax credits. |

| Medicaid Expansion | Some states have expanded Medicaid eligibility under the ACA, providing healthcare coverage to low-income individuals and families. |

“The ACA’s approach to cost control is multifaceted, encompassing market reforms, preventive care, cost-sharing reductions, and other initiatives. The effectiveness of these measures varies depending on specific circumstances and contexts.”

Coverage and Benefits

The Affordable Care Act (ACA) significantly reshaped healthcare access by establishing essential health benefits (EHBs) that most health plans must include. Understanding these benefits is crucial for consumers navigating the marketplace and ensuring they receive comprehensive coverage. This section dives into the details of required coverage, different types of benefits offered, and how pre-existing conditions are handled under the ACA.

Essential Health Benefits

The ACA mandates that most health plans offered in the marketplace must include essential health benefits. These benefits are designed to provide comprehensive coverage for a range of medical needs. Failure to include these benefits can result in penalties for the insurance companies. Knowing the specific benefits included in your plan is key to making informed decisions about your health insurance.

Types of Coverage

The ACA mandates a broad range of coverage, including preventive care, mental health services, and substance abuse services. These crucial elements contribute to overall well-being.

- Preventive Care: The ACA significantly expanded coverage for preventive services, including vaccinations, screenings, and counseling. This preventative approach is cost-effective in the long run by detecting potential health issues early.

- Mental Health and Substance Use Disorder Services: The ACA requires plans to cover mental health and substance use disorder services, promoting access to care for these critical health areas. This addresses the often overlooked mental health aspect of a comprehensive health care system. It’s crucial to seek help for these conditions as they are just as important as physical health.

Pre-Existing Conditions

A critical aspect of the ACA is its protection against discrimination based on pre-existing conditions. The ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. This means individuals with conditions like diabetes, asthma, or heart disease can obtain health insurance without facing significant obstacles or penalties.

Preventive Care Services

The ACA mandates that most health plans cover certain preventive services without cost-sharing. This allows individuals to access these services without worrying about incurring significant out-of-pocket expenses.

| Type of Preventive Care | Description |

|---|---|

| Vaccinations | Coverage for recommended vaccinations, protecting against various preventable diseases. |

| Screenings | Coverage for recommended screenings for conditions like cancer, diabetes, and high blood pressure. |

| Well-woman visits | Coverage for routine checkups for women. |

| Well-child visits | Coverage for routine checkups for children. |

| Chronic disease management | Coverage for ongoing management of chronic conditions. |

Individual Mandate and Tax Penalties

The Affordable Care Act (ACA) included a provision requiring most Americans to have health insurance. This “individual mandate” aimed to increase the number of insured individuals, reduce the cost of healthcare for everyone, and stabilize the insurance market. However, this provision has been a source of significant debate and legal challenges.The individual mandate required most Americans to have qualifying health insurance coverage, or face a penalty.

This penalty was intended to incentivize individuals to obtain insurance. The penalty was calculated as a percentage of income, and varied from year to year. The mandate’s complexities and the associated penalties led to considerable controversy and legal challenges.

Individual Mandate Requirement

The individual mandate required most US residents to maintain minimum essential health coverage. Failure to do so resulted in a tax penalty. This requirement was intended to encourage more people to purchase health insurance, leading to a healthier and more stable insurance market. This, in turn, was expected to lower healthcare costs overall.

Penalties for Non-Compliance

The penalty for non-compliance with the individual mandate was a tax imposed on individuals who did not have minimum essential coverage. The penalty amount was adjusted annually as a percentage of income. For example, in 2019, the penalty was capped at $695 per adult or 2.5% of household income, whichever was higher. These penalty amounts were subject to yearly adjustments.

Challenges and Modifications to the Mandate

The individual mandate faced several legal challenges, primarily focused on the constitutionality of the penalty. The Supreme Court upheld the ACA’s core provisions in 2012, but the individual mandate’s implementation and subsequent penalties remained a contentious issue. Subsequent modifications to the ACA, or legislation enacted alongside it, led to changes in the mandate’s application and the associated penalties.

For instance, certain provisions of the law might have allowed for specific exemptions from the mandate.

Comparison with Other Countries’ Policies

| Country | Policy | Details |

|---|---|---|

| United States (ACA) | Individual Mandate | Requires most Americans to have health insurance or pay a penalty. Penalty amounts and eligibility exemptions vary. |

| Canada | Universal Healthcare | Comprehensive healthcare system funded through taxes. Citizens have access to care regardless of income. |

| Germany | Social Health Insurance | A mixed system with compulsory health insurance and private options. A robust network of hospitals and clinics. |

| United Kingdom | National Health Service | Free healthcare for all citizens funded through general taxation. Emphasizes preventative care and public health. |

The table above provides a brief overview. Further research on each country’s specific healthcare policies is recommended for a more comprehensive understanding. These examples illustrate the diverse approaches to healthcare access and coverage around the world.

Medicaid Expansion and CHIP: Affordable Care Act What You Should Know

The Affordable Care Act (ACA) significantly impacted access to healthcare for low-income individuals and families by expanding Medicaid eligibility and strengthening the Children’s Health Insurance Program (CHIP). These provisions aimed to increase coverage for vulnerable populations, reducing healthcare disparities and promoting overall public health. This section details the ACA’s approach to Medicaid expansion and CHIP, including eligibility criteria and the resulting impact on healthcare access.

So, you’re looking into the Affordable Care Act? Knowing your options is key, but sometimes health questions pop up unexpectedly, like wondering if you can gargle with peroxide. For that, check out this helpful resource on can you gargle with peroxide. Regardless of the unexpected health query, understanding your healthcare options and the ACA is important.

Keep researching, and you’ll be well-informed!

Medicaid Expansion

The ACA aimed to increase Medicaid coverage by allowing states to expand eligibility for the program to adults with incomes up to 138% of the federal poverty level. This expansion was designed to reduce the number of uninsured individuals in these states, particularly among those in low-income brackets. However, not all states opted to expand Medicaid. The variation in state decisions regarding expansion resulted in significant disparities in healthcare access across the country.

So, you’re diving into the Affordable Care Act? Knowing your rights and responsibilities is key. Understanding your health insurance options and coverage is crucial. For example, if you’re dealing with a sore throat, knowing how long it typically lasts can help you determine if it’s something you need to see a doctor about. Check out this helpful guide on how long does a sore throat last to get a better understanding of the typical duration of a sore throat.

This information, combined with your ACA knowledge, will help you make informed decisions about your healthcare needs.

Impact on Healthcare Access and Affordability

Medicaid expansion has demonstrably increased access to healthcare services for eligible individuals in states that opted for expansion. Access to primary care, preventive services, and specialized care has improved, resulting in better health outcomes and reduced hospitalizations, especially for those with chronic conditions. Studies have shown a positive correlation between Medicaid expansion and lower rates of preventable hospitalizations and emergency room visits.

However, in states that did not expand Medicaid, the number of uninsured individuals remained high, leading to potential adverse health outcomes and increased healthcare costs in the long run.

Children’s Health Insurance Program (CHIP)

The ACA strengthened the Children’s Health Insurance Program (CHIP) by ensuring its continued funding and increasing its accessibility to low-income families. CHIP provides health coverage to children whose families earn too much to qualify for Medicaid but cannot afford private health insurance. The ACA amendments enhanced the program’s capacity to serve more children in need. The ACA provisions focused on expanding eligibility and coverage under CHIP, thereby increasing the number of children with health insurance.

Navigating the Affordable Care Act can feel overwhelming, but knowing the basics is key. Understanding your options and coverage is crucial, especially when considering factors like pre-existing conditions. For instance, did you know that food allergies are a significant health concern, affecting millions? Checking out food allergies facts and statistics might help you better grasp the importance of comprehensive healthcare.

Ultimately, the ACA is about ensuring access to quality care for everyone, regardless of their health background.

Medicaid Expansion Eligibility Criteria

Medicaid expansion eligibility criteria vary slightly from state to state, but generally, individuals must meet specific income requirements. The income limits are tied to 138% of the federal poverty level, meaning eligibility is determined by income relative to a nationally standardized poverty threshold. This threshold is adjusted periodically to reflect changes in the cost of living. Additionally, states can establish specific criteria for eligibility, such as residency requirements or citizenship status.

CHIP Eligibility Criteria

The Children’s Health Insurance Program (CHIP) eligibility criteria are designed to provide health insurance coverage to children in families who cannot afford private insurance. Income guidelines for CHIP vary by state, but generally, they are determined by a percentage of the federal poverty level, with a higher income threshold than for Medicaid. Additional requirements might include factors such as age and residency, depending on the state’s specific CHIP program.

Employer Responsibilities

The Affordable Care Act (ACA) significantly impacts employers, placing certain requirements on them regarding their employees’ health insurance. Understanding these responsibilities is crucial for both employers and employees to navigate the healthcare landscape. This section delves into the specifics of employer responsibilities under the ACA, including the implications for small businesses and potential penalties for non-compliance.

Employer Mandate Requirements

The ACA mandates that employers with a certain number of full-time employees provide them with affordable health insurance. Failure to do so can result in significant penalties. The specific number of employees required to offer coverage varies based on the year and is subject to change, so employers should consult updated resources from the IRS. This requirement aims to expand health insurance coverage and reduce the burden on individuals.

Impact on Small Businesses

Small businesses face unique challenges in complying with the ACA’s employer mandate. The costs of providing health insurance can be substantial, especially for smaller operations with limited budgets. Many small businesses are unable to afford the premiums for comprehensive health insurance plans, which can potentially leave employees uninsured or underinsured. The ACA offers some flexibility for small businesses, including the ability to join a health insurance purchasing pool.

Penalties for Non-Compliance

Employers who fail to comply with the ACA’s employer mandate face penalties. These penalties are calculated based on the number of full-time employees who are not offered affordable health insurance coverage. The penalties can be substantial and can significantly impact a business’s financial stability. These penalties act as a deterrent to discourage employers from avoiding their responsibilities under the ACA.

Compliance Approaches for Employers

Several approaches can help employers comply with the ACA’s employer mandate. One approach is to offer affordable health insurance plans to employees. Another option is to utilize health insurance purchasing pools, which allow small businesses to combine their resources and potentially secure more affordable coverage options. Additionally, employers can explore other strategies such as using health savings accounts (HSAs) or flexible spending accounts (FSAs) to reduce the financial burden on employees and themselves.

Seeking guidance from qualified professionals, such as HR consultants or tax advisors, can provide tailored advice and strategies.

Potential Issues and Challenges

The Affordable Care Act (ACA), while aiming to expand access to affordable healthcare, has faced significant challenges and criticisms since its implementation. These issues range from concerns about the individual mandate’s effectiveness to debates about the program’s impact on healthcare disparities and overall cost-effectiveness. Understanding these challenges is crucial for evaluating the ACA’s long-term success and identifying potential areas for improvement.The ACA’s implementation has been marked by ongoing debates and diverse interpretations of its provisions.

These varying perspectives often stem from differing economic and political viewpoints, and highlight the complexities of navigating healthcare policy in a pluralistic society. Different stakeholders, including insurers, providers, and consumers, have often held conflicting views regarding the ACA’s effectiveness and its impact on their specific situations.

Criticisms of the Individual Mandate

The individual mandate, requiring most Americans to have health insurance or pay a penalty, has been a frequent target of criticism. Opponents argue that it infringes on individual liberty and that the penalties are insufficient to encourage compliance. Furthermore, the mandate’s complexity and potential for confusion have contributed to the overall perception of the ACA as a cumbersome and poorly designed program.

Concerns about Healthcare Disparities

The ACA has been criticized for its limited ability to address healthcare disparities among different demographics. Studies have shown that certain populations, such as those in rural areas or those with pre-existing conditions, may still face significant challenges in accessing affordable care. The ACA’s focus on expanding coverage hasn’t always translated into equitable access to quality care for all individuals.

Interpretations of ACA Provisions

The ACA’s complex provisions have led to varying interpretations among legal scholars, policymakers, and the public. This ambiguity has often resulted in disagreements over the scope and intent of specific regulations. The legal challenges and court rulings surrounding the ACA have further contributed to these varied interpretations.

Debates on Cost and Effectiveness

While the ACA aimed to lower healthcare costs and improve access, debates continue regarding its overall cost-effectiveness. Critics point to rising premiums and out-of-pocket expenses in some areas as evidence that the program has not achieved its cost-containment goals. Furthermore, the long-term sustainability of the ACA’s funding mechanisms is a subject of ongoing discussion.

Illustrative Examples

The Affordable Care Act (ACA) has had a profound impact on healthcare access for millions of Americans. Understanding how it affects different demographics and health conditions is key to grasping its true value. This section will explore real-world scenarios highlighting the positive and sometimes challenging aspects of the ACA for various groups.The ACA aimed to make health insurance more accessible and affordable, but its impact varies significantly based on individual circumstances.

Factors like income, family size, pre-existing conditions, and employment status all play a role in shaping the experience. The examples below demonstrate how the ACA has provided support and challenges in different situations.

Young Adults

Young adults, often struggling to find affordable coverage after leaving their parents’ plans, often benefit from the ACA’s provisions. The law allows young adults to remain on their parents’ plans until age 26, providing a crucial bridge into independent coverage. This extension reduces the risk of gaps in coverage and promotes stability in their health insurance.

Families

Families with children often find the ACA’s subsidies and expanded coverage options advantageous. Many families are eligible for premium tax credits, which significantly lower the cost of health insurance. These credits make health insurance more affordable, allowing families to prioritize their children’s health. However, the affordability can vary based on income and family size, with some families facing challenges in accessing plans that fit their budget.

Seniors

Seniors, often facing high medical costs, are also affected by the ACA. The ACA maintains the marketplace, offering choices of plans for individuals and families, and maintains the role of Medicare. While Medicare remains the primary source of coverage for seniors, the ACA’s impact is felt through the availability of plans in the marketplace, offering options for those with specific needs or those who want to supplement their Medicare coverage.

Illustrative Examples of Positive Impacts

- A young adult, Emily, was able to remain on her parents’ insurance plan until age 26, preventing a gap in coverage and allowing her to access preventative care. This prevented potential health issues from escalating, and contributed to long-term financial stability.

- A family with two children, the Smiths, benefited from premium tax credits, significantly reducing their health insurance costs. This allowed them to allocate more resources to their children’s education and overall well-being, and prevented a substantial financial burden related to healthcare.

Costs and Benefits for Specific Individuals/Families

| Category | Description | Impact |

|---|---|---|

| Young Adult | Limited income, no employer-sponsored plan | Potentially eligible for subsidies; can stay on parent’s plan until 26 |

| Family | Low to moderate income, children | Potentially eligible for premium tax credits; more affordable plans |

| Senior | Existing Medicare coverage, limited income | Potential to supplement coverage through marketplace plans |

Individuals with Specific Health Conditions

- Individuals with pre-existing conditions are protected under the ACA. The law prohibits insurers from denying coverage or charging higher premiums based on pre-existing conditions. This protection has significantly improved access to healthcare for those with chronic conditions.

- Those with chronic conditions may experience higher premiums, but the protection from discrimination is significant. They can still find coverage options, albeit with potentially higher costs.

Conclusion

In conclusion, the Affordable Care Act, while facing ongoing debate and challenges, remains a significant policy influencing healthcare access and affordability. Its impact on individual and employer responsibilities, coverage provisions, and potential issues deserves careful consideration. Understanding the nuances of the ACA is vital for informed decision-making and a clearer grasp of the US healthcare system.